TL;DR

- This is really for the peoples who shop a lot at Target and/or Amazon (with Prime membership)

- Sign up for the right cards and you can earn 5% off everything you buy at Target and Amazon, including Whole Foods

- <5 minutes to apply for each card

- Amazon Prime Visa card has a $100 sign up offer

- Target Red Card offers come and go ($40 from Nov 1 – Dec 26, 2020)

- Value of savings if you spend $5k a year at those two stores = $250 + $100 (Amazon sign up) + $40 (Target Sign up) = $390

- $390 / 10 min = $2,340 per hour – it was worth my time!

- Plastic overload is a problem – you don’t need to carry either card to get full value!

The deal

A significant portion of our family spend goes to Target and Amazon. By signing up for the right piece of plastic, you can save 5% on pretty much everything you buy there. As an extra bonus, there can be a sign up bonus for each card

Amazon

Assuming find an Amazon Prime membership worthwhile, the Amazon Prime Visa card is a no brainer.

- $0 annual fee

- $100 Amazon Gift Card on sign up (As of Dec 15, 2020)

- 5% cash back on everything at Amazon and Whole Food

- Occasionally massive bonuses (e.g. 20% off)

- Add to your Amazon.com account for online purchases and Apple Pay to use in store at Whole Foods

The key caveat is if you are an active player in the credit card game. It’s issued by Chase and subject to their 5/24 rule which limits you to 5 new personal credit cards opened in the past 24 months.

Below shows that this really doesn’t make sense without Amazon Prime

Target

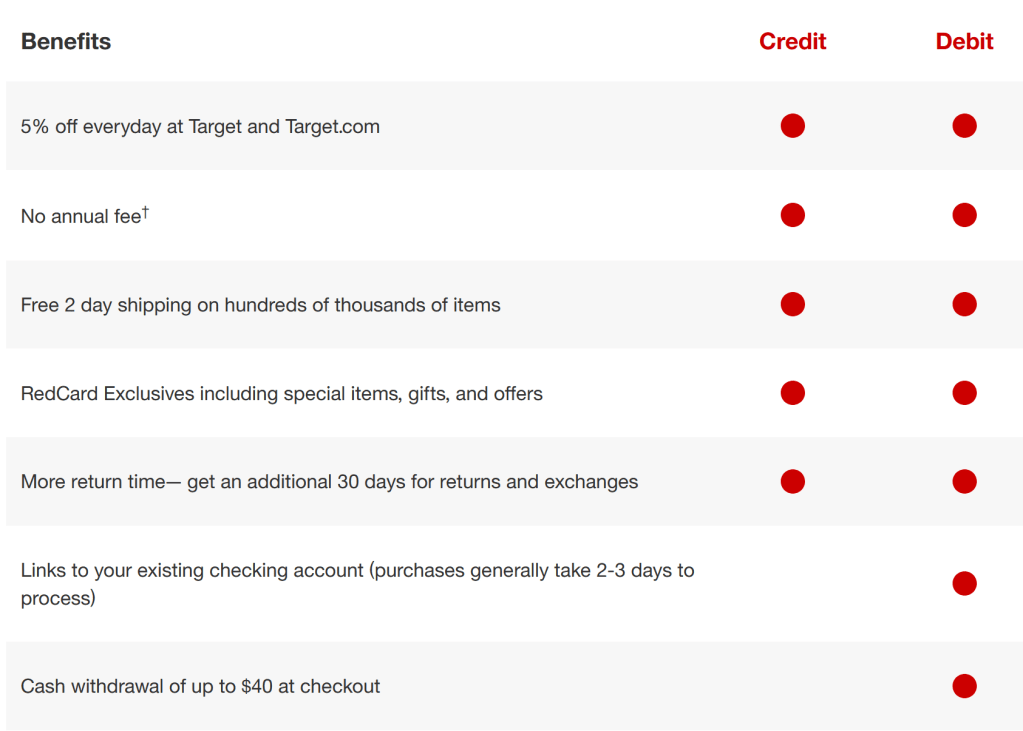

Target offers a choice of a Red Card as a debit card or credit card. Assuming you can manage the variable spend of transactions posting to your checking account, I recommend the debit card. I only sign up for credit cards that offer significant sign up bonuses or value. At Target, there’s no incremental value in having their credit card.

- Debit card recommended

- Occasional $40 sign on bonus – currently active from 11/01/2020 – 12/26/2020

- Free 2 day shipping with no minimums

- Extra 30 days for returns

- Can be used directly from the Target.com app

Travel light – you don’t need to carry these cards

Highly specialized cards can make your wallet a lot thicker very quickly. The good news is that both of these cards can be used card-free

| Amazon Prime Visa card | – Add to Amazon.com account – Add to Apple Wallet |

| Target Red Card | – Use via Target app |

Conclusion

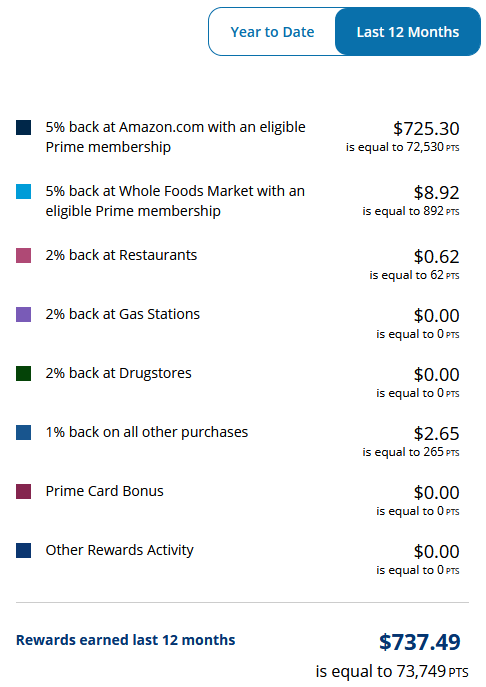

Can you spend 10 minutes to save yourself hundreds of dollars doing what you were going to do anyways? In the past 12 months, this saved me >$725 with zero effort.

Living in NYC, we pretty bought the majority of our items and groceries at Amazon. I convert these points into cash and it goes straight into my bank account. Final note – although they give you the option, I wouldn’t “shop” with them on Amazon as I don’t get the 5% discount. Move the cash into your checking account / pay off the balance and put the new spend directly on the card.