TL;DR

- $700 if you have $50,000 / $300 if you have $10,000 to keep with Citi for 60 days

- $1,500 if you have $200,000 to keep with Citi for 60 days (not for most people)

- Savings earns 0.5% APY on the cash (among the best as of March 2021) – Citi Accelerate savings – available in 42 states – TX yes / NY no

- All earnings are taxable on your 1099-INT

- You can downgrade account types after hitting qualification criteria to avoid monthly fees

- Cannot have had a Citi account in the past 180 calendar days

- Great if you have a major purchase coming up (e.g. house) or maintaining a healthy rainy day fund (6 months of expenses)

- Solid checking account with option to earn Citi Thankyou Points

- Act now – current promo expires

April 1, 2021Oct 4, 2021 (and will probably continue to be be rolled forward)

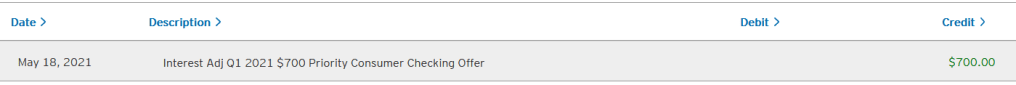

[UPDATE – Citi paid the $700! We’ll have to pay tax on it, but it’s free money!]

Why keep so much cash?

$50,000 is a lot of money, but could be the right number for a emergency cushion if you have a household annual spend of $100,000+. This means 6 months of highly liquid funds for emergencies.

In our case, we are actually building a house with a 6 month construction time frame. While we could roll the dice and put it into the stock market, we are following the conventional financial planning advice that our down payment should be kept in highly liquid, low volatility instruments (i.e. cash)

Why not the $1,500 offer?

It’s asking for about 4x the money for only 2x the reward. It’s also much more than most families would need for a reserve fund. If part of your investment strategy is to have $200,000 cash (lots of good reasons to do so for the right person), you should definitely go for it!

What do I think of the overall Citi package?

Most of us need some form of banking service. You might as well get rewards for doing the basics. Citi offers their own points program called Citi Thank You points that are worth about $0.005 – $0.05 per point. It’s pretty easy to earn 675 points per month ($3-$33) on an ongoing basis via Direct Deposit, Auto Save (move $5 per month to a savings account) and having a Savings/Money Market Account.

Citi also has branches across the company and if you maintain $50k for the Citi Priority Account Package has free checks and waives ATM fees with a solid online banking platform.

Sign up / learn more here from Citi